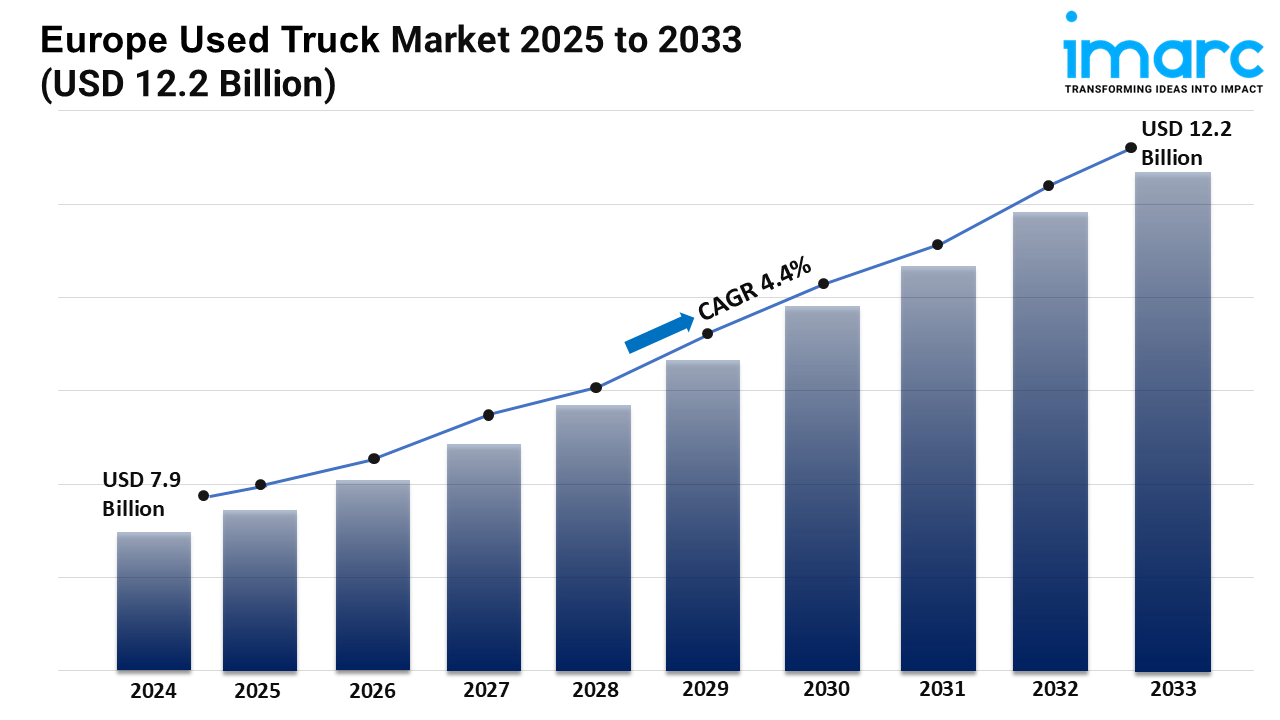

Europe Used Truck Market Forecast by 2033

Market Size in 2024: USD 7.9 Billion

Market Forecast in 2033: USD 12.2 Billion

Market Growth Rate 2025-2033: 4.4%

The Europe used truck market is steadily accelerating from USD 7.9 billion in 2024 toward USD 12.2 billion by 2033, reflecting a compound annual growth rate of 4.4%. This consistent expansion is fuelled by a potent mix of cost-conscious logistics operators, tightening emission legislation, and the rapid digitisation of buying channels that make pre-owned trucks more transparent, traceable, and affordable than ever.

Growth Drivers Powering the Europe Used Truck Market

Euro 7 & Low-Emission Zone Mandates

In April 2024, the Council of the European Union formally adopted the Euro 7 regulation, imposing stricter lifetime emission limits and battery-durability standards for heavy-duty vehicles. Rather than absorbing the price shock of new Euro 7-compliant rigs, fleet owners are turning to late-model used trucks that already meet Euro 6 standards but cost 30–40 % less. Cities such as Milan, Paris, and Madrid have simultaneously expanded low-emission zones, banning pre-Euro 6 vehicles from urban cores. This regulatory squeeze is funnelling demand toward certified pre-owned Euro 6 stock, accelerating turnover and supporting higher residual values across dealer networks.

E-Commerce Boom & Last-Mile Logistics

According to the International Trade Administration, Europe generated USD 631.9 billion in retail e-commerce revenue during 2023 and is projected to reach USD 902.3 billion by 2027, a CAGR of 9.31 %. Parcel volumes are exploding, yet profit margins remain razor-thin. SMEs and 3PL operators are therefore opting for used light and medium-duty trucks to scale last-mile fleets quickly without the capital burden of new vehicles. The shift is visible in Germany’s DHL Supply Chain, which added 1,200 refurbished vans in 2024 to serve same-day delivery contracts, cutting acquisition costs by 25 % while meeting urban emission standards.

Digital Marketplaces & OEM-Backed Certification

Online platforms are eliminating traditional information asymmetry. Scania UK launched an end-to-end digital sales portal in April 2024, allowing buyers to filter by mileage, Euro class, warranty, and financing terms, with virtual 360-degree walk-arounds and AI-generated condition reports. DAF Trucks reported a 17 % uplift in used-truck turnover after embedding PACCAR Financial leasing options (24–60 months) directly into its platform. Peer-to-peer and independent dealer listings now coexist with OEM-certified programmes that extend driveline warranties up to 36 months, giving smaller operators bankable reliability that was once the preserve of new-truck buyers.

Request a Free Sample Report: https://www.imarcgroup.com/europe-used-truck-market/requestsample

Europe Used Truck Market Segmentation

Analysis by Vehicle Type

Light Trucks

Medium-Duty Trucks

Heavy-Duty Trucks

Analysis by Sales Channel

Franchised Dealer

Independent Dealer

Peer-to-Peer

Analysis by End User

Construction

Oil and Gas

Others

Country Analysis

Germany

France

United Kingdom

Italy

Spain

Others

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Europe Used Truck Market News

April 2024: Scania UK debuted a fully digital used-truck portal with 360-degree virtual tours and integrated financing.

September 2024: DAF Trucks showcased next-gen XD, XF, XG, and XG+ models, highlighting battery-electric variants alongside certified pre-owned stock.

March 2024: Volvo Trucks UK extended driveline warranties on used trucks to 36 months, matching new-truck coverage.

Key highlights of the Report:

Market Performance (2019-2024)

Market Outlook (2025-2033)

COVID-19 Impact on the Market

Porter’s Five Forces Analysis

Strategic Recommendations

Historical, Current and Future Market Trends

Market Drivers and Success Factors

SWOT Analysis

Structure of the Market

Value Chain Analysis

Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Write a comment ...