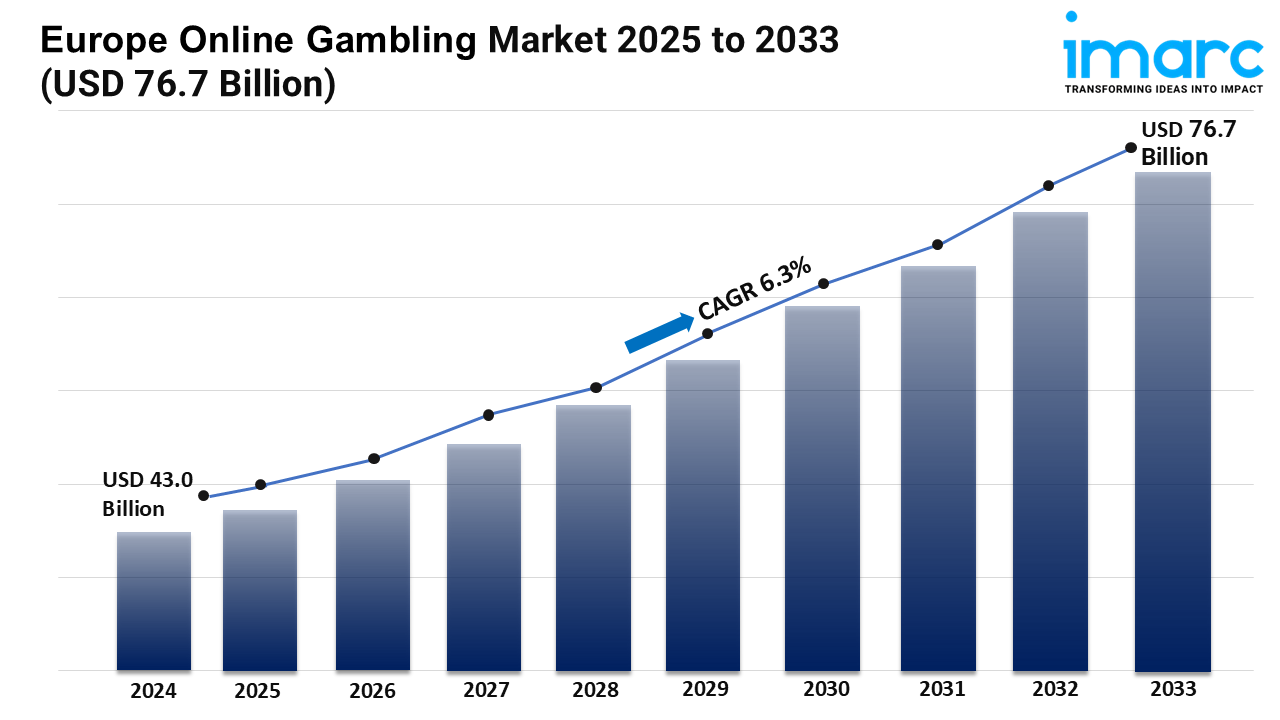

Europe Gaming Market Forecast by 2033

Market Size in 2024: USD 84.8 billion

Market Forecast in 2033: USD 176.2 billion

Market Growth Rate 2025-2033: 8.0%

Europe’s gaming ecosystem is on a turbo-charged trajectory. After reaching USD 84.8 billion in 2024, the Europe gaming market is projected to almost double to USD 176.2 billion by 2033, underpinned by ubiquitous smartphones, booming e-sports arenas and breakthrough innovations in cloud gaming and VR.

Growth Drivers Accelerating the European Gaming Market

5G & Fibre Roll-Outs Unlock Cloud Gaming

Eurostat notes that 91% of EU households had internet access in 2024, while ETNO recently noted that 5G covered 80% of the population in Europe. Upscaled connectivity was a critical enabler of cloud gaming access in Europe when Xbox Cloud Gaming started to roll out in 22 EU countries in January 2025, allowing users to play AAA titles on a €199 Android tablet without a console. Deutsche Telekom noted a 300% month-on-month rise in 5G data traffic the week after launching the service and that it saw latencies drop to below 20 ms, sufficient for players of competitive shooters. Operators are seeing a 15% lift in average revenue per user, while sales of game-streaming subscriptions have risen steadily, thus initiating a positive cycle of infrastructure deployment and content monetisation.

Government Tax Breaks Turbo-Charge Local Studios

The French Crédit d’Impôt Jeu Vidéo was extended to 2028 at 30% of production spend. In March 2025, Ubisoft Montpellier revealed two open-world titles in production, claiming the tax break was what had enabled the green light on development. In the UK, Games Tax Relief paid out £200 million in FY-2024, allowing Rocksteady to expand its London studio to hire 120 staff to develop a live-service DC title. These supports help studios reduce break-even points, accelerate timelines to profitability and keep more European IP on-shore, thus driving new jobs and earlier time-to-market that flows through to higher consumer spend.

E-Sports Explosion Fuels Monetisation

The gaming industry continues to gain traction among European consumers, with 54% of respondents now identifying as players, resulting in a massive €26.8 billion sector across Europe. E-sports also gained a foothold over the last decade, from niche fan bases to stadium-sized successes. The 2025 League of Legends European Championship sold out the Accor Arena in Paris in just 18 minutes, with concurrent Twitch viewership peaking at 1.8 million. Multi-million euro sponsorships have been unlocked as overall marketing budgets shift, with Adidas unveiling a multi-year stadium jersey sponsorship deal with Team Vitality, and BMW re-upping its deal with Fnatic. In-game cosmetics sales tied to e-sports tournaments and leagues and team profiles (team skins, battle passes, club passes, etc.) are generating consistent revenue that flattens out seasonality and extends the monetisation tail thanks to long-term player investment organically tied to in-game performance and league results.

Request a Free Sample Report to Access Full Data: https://www.imarcgroup.com/europe-gaming-market/requestsample

Europe Gaming Market Segmentation

Analysis by Device Type

Consoles

Mobiles and Tablets

Computers

Analysis by Platform

Online

Offline

Analysis by Revenue Type

In-Game Purchase

Game Purchase

Advertising

Analysis by Type

Adventure/Role Playing Games

Puzzles

Social Games

Strategy

Simulation

Others

Analysis by Age Group

Adult

Children

Analysis by Country

Germany

France

United Kingdom

Italy

Spain

Others

Top European Gaming Companies:

CD Projekt S.A., Embracer Group, Enad Global 7 AB (publ), Focus Entertainment, Gameloft SE, Keywords Studios Plc, Nacon, Paradox Interactive AB, Thunderful Group AB, Ubisoft Entertainment SA, etc.

Europe Gaming Market News

August 2025 – Assassin’s Creed Shadows became the best-selling new game of 2025 in Europe, topping the GSD charts ahead of Monster Hunter Wilds and Kingdom Come: Deliverance 2.

January 2025 – Xbox Cloud Gaming rolled out across 22 EU countries, triggering a 300 % spike in Deutsche Telekom 5G data traffic the week after launch.

March 2025 – Ubisoft Montpellier announced two new open-world titles, citing France’s 30 % tax rebate as critical to project approval.

January 2025 – The League of Legends European Championship sold out Paris Accor Arena in 18 minutes, while Twitch concurrent viewership peaked at 1.8 million

Key highlights of the Report:

Market Performance (2019-2024)

Market Outlook (2025-2033)

COVID-19 Impact on the Market

Porter’s Five Forces Analysis

Strategic Recommendations

Historical, Current and Future Market Trends

Market Drivers and Success Factors

SWOT Analysis

Structure of the Market

Value Chain Analysis

Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Write a comment ...